Life Insurance in and around Rapid City

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

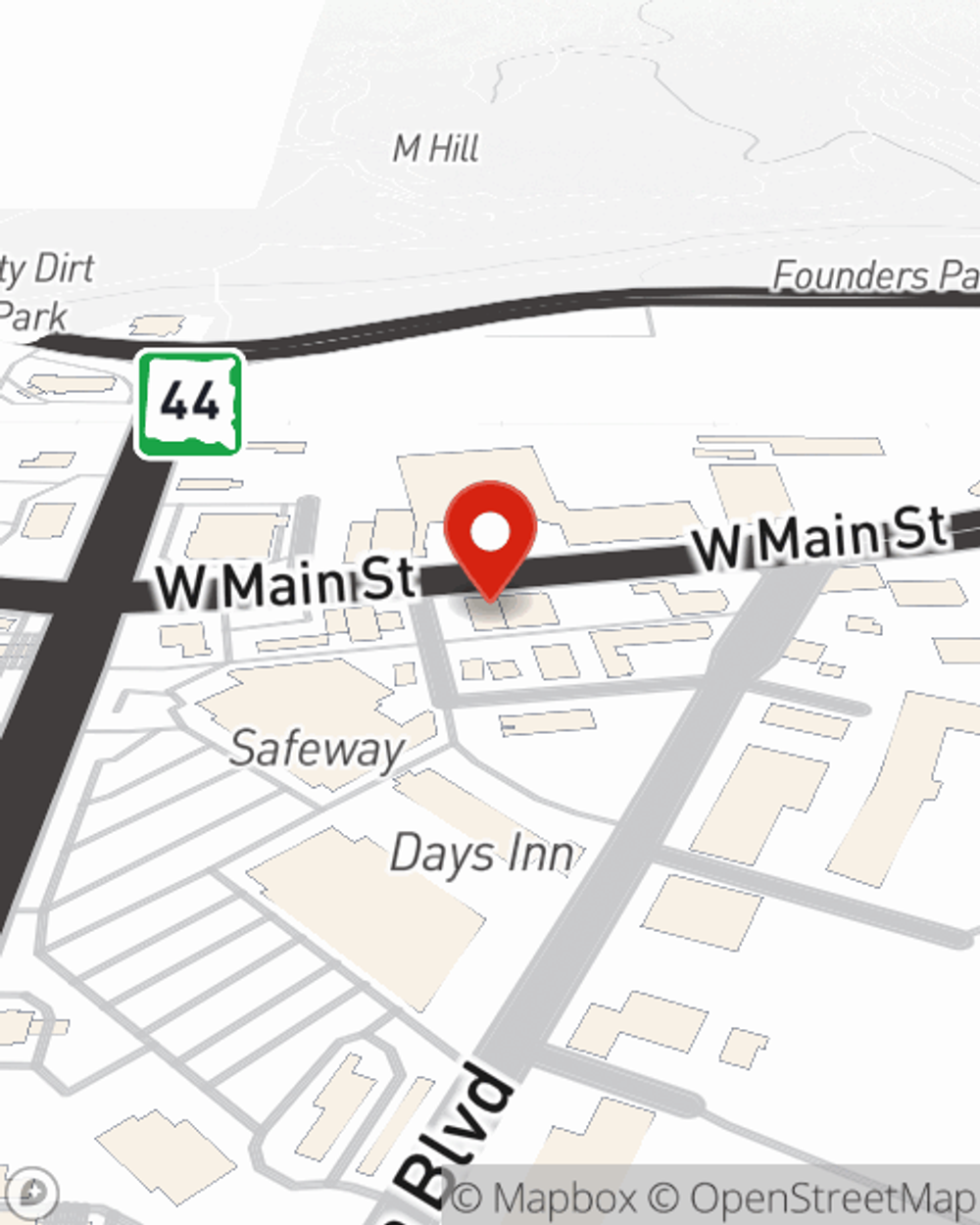

- Rapid City

- Rapid Valley

- Black Hawk

- Summerset

- Black Hills

- West River

It's Never Too Soon For Life Insurance

When it comes to dependable life insurance, you have plenty of choices. Evaluating riders, providers, coverage options… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Andy A Ainslie is a person who can help you build a policy for your specific situation. You’ll have a straightforward experience to get reasonably priced coverage for all your life insurance needs.

Insurance that helps life's moments move on

Life happens. Don't wait.

State Farm Can Help You Rest Easy

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Andy A Ainslie is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

It's always a good time to make sure your loved ones have coverage against the unexpected. Get in touch with Andy A Ainslie's office to experience what State Farm can do for you.

Have More Questions About Life Insurance?

Call Andy A at (605) 348-3338 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Andy A Ainslie

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.